Banking app design

Design Brief

Too many mobile banking apps today are clunky, difficult to get around and just a pain to use. Can you rethink a mobile banking app from the ground up, so it can meet the needs of today’s user.

We’d like you to identify what these needs are based on personal experience or the experience of your friends and family. How can the app help with these tasks – some of which might be higher frequency than others.

In addition, can you think of some features that would go above and beyond basic banking tasks? How can the app create stickiness for the bank so the user chooses it over others?

App Features

-

To make the app & account usages secure. 2nd level security added to app usage.

under Security there are options to use & create personalised Gestures, Front camera or touch id if available to view hidden account information. -

By analysing account usage, providing users with credible suggestions on their Savings & Investment

Role

UX, UI, Information architecture, Research, Concept

Tools

Photoshop, Indesign, Balsamiq, pen and paper for wireframes

Context

Today, service sector contributes the maximum share of India’s Gross Domestic Product (GDP). It comprises of trade, communication, financial system, insurance, community, social and personal services.

Today the banking industry, which was tightly protected by regulations is now experiencing a rapid change. Now it is no more confined to nationalised and cooperative banks but has emerged with multinational banks who have spread their branches across the length and breadth of the country.

Due to tough competition in the banking sector and due to the entry of private players, the quantity of services of the banks are increasing day by day but as far as quality is concerned, it is continuously deteriorating. Today the customer is interested in how he/she can benefit from the banks and their products. That is why it becomes necessary for a bank to differentiate its products from the others.

Indian banks have now realised that it no longer pays to have transaction based operating. This has shifted their focus from operational services to customer centric services. Today they are looking at newer ways to make a customer’s banking experience more convenient and effective. This can be done by using new technology, tools and techniques to identify customer needs and then offering products to match.

Design Process

Preparation

Explore Context

Banking Industry in India

Issues with present apps

Identify Users

User feedback on pain points & delightful experiences using present banking apps

Unfold Challenges

Study

Users attention span

Data Encryption & app security

Perceive

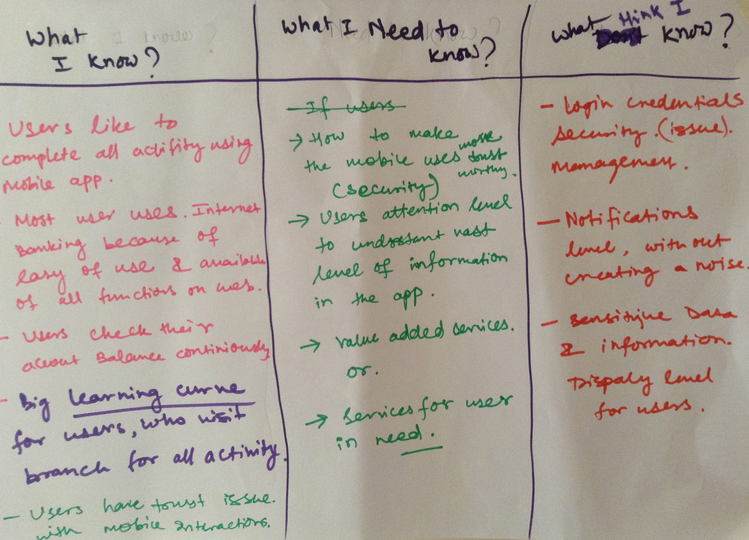

Research Strategy

Interview

Web Search

Persona Creation Identify,

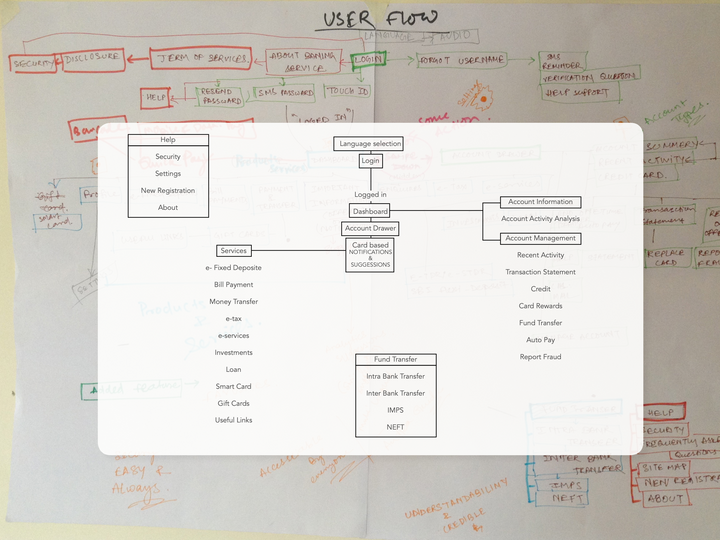

What I know ! What I think I know ! What I need to know ? exercise

Analysis & Task creation Develop Concept

Idea Model (Decide user flow)

Wireframes/Solution

Project Description

Test

Improve

Research

Different Types of Services | Bank Accounts

Individual Banking

Banks typically offer a variety of services to assist individuals in managing their finances, including: Checking accounts, Savings accounts Debit & credit cards Insurance, Wealth management

Business Banking

Most banks offer financial services for business owners who need to differentiate professional and personal finances.

Different types of business banking services include: Business loans, Checking accounts, Savings accounts, Debit and credit cards, Merchant services (credit card processing, reconciliation and reporting, check collection), Cash management (payroll services, deposit services, etc.)

Digital Banking

The ability to manage your finances online from your computer, tablet, or smartphone is becoming more and more important to consumers. Banks will typically offer digital banking services that include: Online, mobile, and tablet banking Mobile check deposit, Text alerts, eStatements, Online bill pay

Loans

Loans are a common banking service offered, and they come in all shapes and sizes. Some common types of loans that banks provide include: Personal loans, Home equity loans, Home equity lines of credit Home loans, Business loans

Identified Challenges for mobile banking

1. Too much information for an mobile interface (best accessible through web)

2. Big learning curve for new users.

3. Trust issue, doubt on encryption & security of account information & data

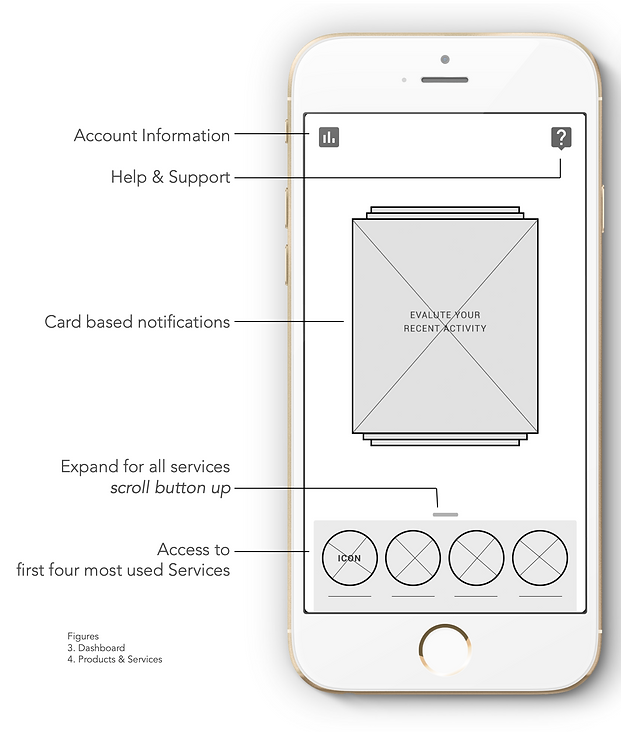

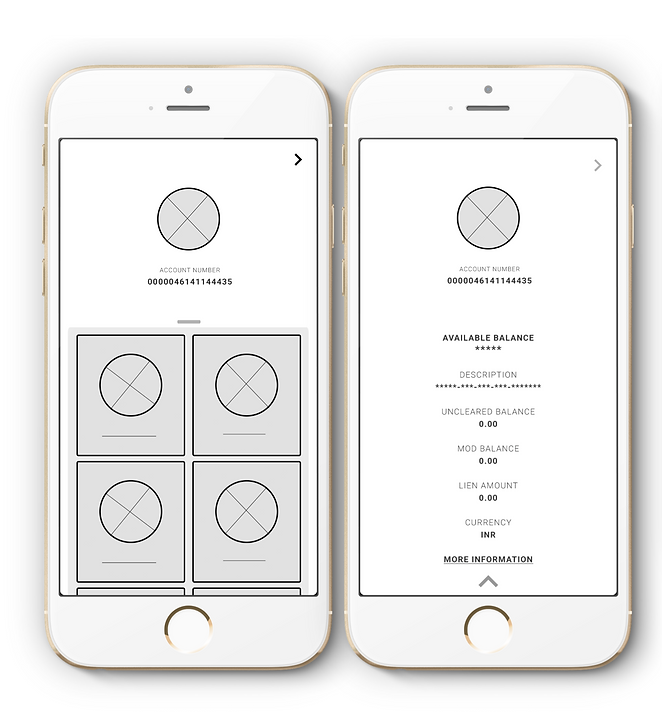

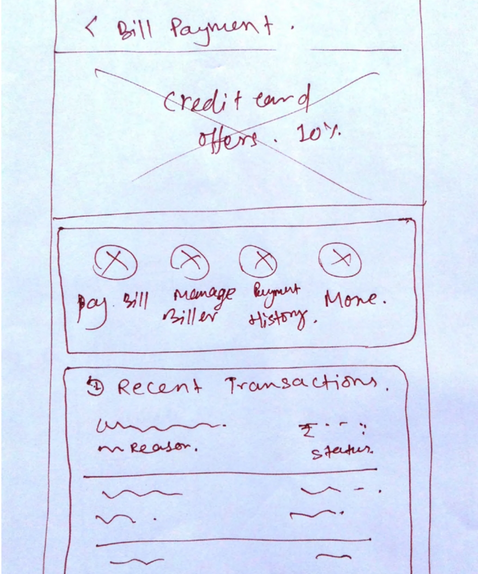

Paper Wireframes

It helped for quick iteration. Also, finalising the whole flow and communicate the concept.

Features

-

Option to use most regional written languages.

-

To make the app & account usages secure. 2nd level security added to app usage. Under SECURITY there are options to use & create personalised Gestures, Front camera or Touch Id if available to view hidden account information.

-

By analysing account usage, providing users with credible suggestions on their Savings & Investment.